Apartment, group mail boxes or business mail boxes. We don't maintain locks and keys for apartment or business mail boxes. Please contact your building manager or superintendent. For group mail boxes, you're responsible for securing, maintaining and replacing the locks and keys yourself. Is snow preventing you from getting to your mailbox?

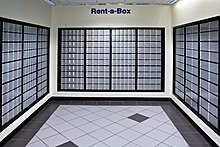

A New York City woman is convinced her apartment is haunted after uncovering a creepy hidden room straight out of a horror flick. She documented the spine-tingling discovery in a series of TikTok. APARTMENT LETTER-BOX 92X. Stand for apartment letterbox. Post box marking. Fire rated access panels. Post Boxes Multi Occupancy Post Boxes Our range of secure letterboxes for flats, apartment blocks or commercial offices are perfect for buildings with more than one address and can be configured into banks of post boxes. Order your multi occupancy post box with Safe today.

We think it's important for you to understand how we make money. It's pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform (and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That's why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can.

So you've found the perfect apartment for rent and can't wait to move. Maybe you're already daydreaming about entertaining in your new place or padding into the kitchen at sunrise to brew some coffee.

Then you hear those dreaded words from the leasing office: 'We'll need you to authorize a background and credit check.'

What are you to do if you just graduated and don't have a rental history? Or your credit reports still show credit card delinquencies from that lean period a few years back? Superset metabase.

Apartment Style Post Boxes

Even if you have no credit history or poor credit, there are still ways you can sign a lease. It may just take a little persuasion, explanation of credit dings and proof that you're a responsible renter.

So don't allow a credit check to scare you away. You might still be able to convince the leasing office that you'll pay your rent on time.

Working on your credit? Check My Equifax® and TransUnion® Scores NowHow to rent an apartment with no or poor credit:

The chance you'll guess which type of credit score will be used for the tenant screening is as likely as 'catching lightning in a bottle,' says Terry Clemans, executive director of the National Consumer Reporting Association, a nonprofit trade organization of consumer reporting agencies and associated professionals.

It could be a FICO score, VantageScore or another model entirely. Screening may only be based off one credit bureau's information or combine information from multiple credit bureaus, depending on which screening company is used and what type of report the landlord requests.

Fortunately, you don't need to live the rest of your life with Mom and Dad just because you have no or poor credit. Here are eight things you can do to bolster your chances of signing that apartment lease.

1. Know where you stand

Before apartment shopping, it's a good idea to get your free Equifax and TransUnion credit scores and reports from Credit Karma. You can also get a free copy of your credit report from each of the three main credit bureaus every year at AnnualCreditReport.com.

'Look at legitimate, free sources,' says Clemans. 'Don't buy a score.'

2. Take a closer look

Your credit scores are calculated using information from your credit reports, so it's important to ensure that your reports accurately represent your credit history. Look for incorrect items that can be disputed.

3. Be upfront about credit issues

When it comes to credit checks, there may be flexibility depending on the property management, says Bruce McClary, vice president of communications at the National Foundation for Credit Counseling, a nonprofit financial counseling organization.

'You may have a back story not relayed in the limited information of the report,' says McClary. 'Giving them information about why there are delinquencies and what you're doing to correct them can make all the difference in the world.'

4. Provide alternate proof of good credit history

Consider providing copies of your cellphone and utilities payment history and information about accounts missing from your credit report to show you've been making regular payments. You could also provide a bank statement showing you have a financial cushion, even if it's small.

Working on your credit? Check My Equifax® and TransUnion® Scores NowCanada Post Apartment Mailboxes

5. Shop in several neighborhoods

Credit requirements might vary, depending on the apartment's location and type of building. 'If the apartment is in a low-income area, the apartment owner may lower the requirement,' says Dan Faller, owner of Apartment Owners Association of California, a business that sells tenant-screening services to apartment owners. Web scrapping services. So if you're unable to secure your dream apartment, don't fret — you may still be approved elsewhere.

6. Get a co-signer or a roommate

You might consider having your parents co-sign if their credit is good, says Faller. Alternatively, consider a roommate with good credit, which could give you a year to straighten out your credit kinks and build a solid rental history. If you go this route, keep in mind that those relationships could be negatively affected if you fall behind on rent.

7. Pay more upfront

If you have the money to spare, you can offer to pay three or four months' rent ahead of time or hand over a higher deposit. More money in advance may convince a leasing agent to rent to you despite any perceived credit risk. Be sure the extra money you pay is documented in the lease or other rental forms.

8. Show that you've taken steps toward rental responsibility

It may help to demonstrate that you're taking steps to get your credit back on track by seeking free rental or credit counseling at a nonprofit organization. 'Working with a credit counselor demonstrates seriousness about resolving a credit problem and can make the difference for a property manager in considering whether you get an apartment,' says McClary.

A New York City woman is convinced her apartment is haunted after uncovering a creepy hidden room straight out of a horror flick. She documented the spine-tingling discovery in a series of TikTok. APARTMENT LETTER-BOX 92X. Stand for apartment letterbox. Post box marking. Fire rated access panels. Post Boxes Multi Occupancy Post Boxes Our range of secure letterboxes for flats, apartment blocks or commercial offices are perfect for buildings with more than one address and can be configured into banks of post boxes. Order your multi occupancy post box with Safe today.

We think it's important for you to understand how we make money. It's pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform (and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That's why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can.

So you've found the perfect apartment for rent and can't wait to move. Maybe you're already daydreaming about entertaining in your new place or padding into the kitchen at sunrise to brew some coffee.

Then you hear those dreaded words from the leasing office: 'We'll need you to authorize a background and credit check.'

What are you to do if you just graduated and don't have a rental history? Or your credit reports still show credit card delinquencies from that lean period a few years back? Superset metabase.

Apartment Style Post Boxes

Even if you have no credit history or poor credit, there are still ways you can sign a lease. It may just take a little persuasion, explanation of credit dings and proof that you're a responsible renter.

So don't allow a credit check to scare you away. You might still be able to convince the leasing office that you'll pay your rent on time.

Working on your credit? Check My Equifax® and TransUnion® Scores NowHow to rent an apartment with no or poor credit:

The chance you'll guess which type of credit score will be used for the tenant screening is as likely as 'catching lightning in a bottle,' says Terry Clemans, executive director of the National Consumer Reporting Association, a nonprofit trade organization of consumer reporting agencies and associated professionals.

It could be a FICO score, VantageScore or another model entirely. Screening may only be based off one credit bureau's information or combine information from multiple credit bureaus, depending on which screening company is used and what type of report the landlord requests.

Fortunately, you don't need to live the rest of your life with Mom and Dad just because you have no or poor credit. Here are eight things you can do to bolster your chances of signing that apartment lease.

1. Know where you stand

Before apartment shopping, it's a good idea to get your free Equifax and TransUnion credit scores and reports from Credit Karma. You can also get a free copy of your credit report from each of the three main credit bureaus every year at AnnualCreditReport.com.

'Look at legitimate, free sources,' says Clemans. 'Don't buy a score.'

2. Take a closer look

Your credit scores are calculated using information from your credit reports, so it's important to ensure that your reports accurately represent your credit history. Look for incorrect items that can be disputed.

3. Be upfront about credit issues

When it comes to credit checks, there may be flexibility depending on the property management, says Bruce McClary, vice president of communications at the National Foundation for Credit Counseling, a nonprofit financial counseling organization.

'You may have a back story not relayed in the limited information of the report,' says McClary. 'Giving them information about why there are delinquencies and what you're doing to correct them can make all the difference in the world.'

4. Provide alternate proof of good credit history

Consider providing copies of your cellphone and utilities payment history and information about accounts missing from your credit report to show you've been making regular payments. You could also provide a bank statement showing you have a financial cushion, even if it's small.

Working on your credit? Check My Equifax® and TransUnion® Scores NowCanada Post Apartment Mailboxes

5. Shop in several neighborhoods

Credit requirements might vary, depending on the apartment's location and type of building. 'If the apartment is in a low-income area, the apartment owner may lower the requirement,' says Dan Faller, owner of Apartment Owners Association of California, a business that sells tenant-screening services to apartment owners. Web scrapping services. So if you're unable to secure your dream apartment, don't fret — you may still be approved elsewhere.

6. Get a co-signer or a roommate

You might consider having your parents co-sign if their credit is good, says Faller. Alternatively, consider a roommate with good credit, which could give you a year to straighten out your credit kinks and build a solid rental history. If you go this route, keep in mind that those relationships could be negatively affected if you fall behind on rent.

7. Pay more upfront

If you have the money to spare, you can offer to pay three or four months' rent ahead of time or hand over a higher deposit. More money in advance may convince a leasing agent to rent to you despite any perceived credit risk. Be sure the extra money you pay is documented in the lease or other rental forms.

8. Show that you've taken steps toward rental responsibility

It may help to demonstrate that you're taking steps to get your credit back on track by seeking free rental or credit counseling at a nonprofit organization. 'Working with a credit counselor demonstrates seriousness about resolving a credit problem and can make the difference for a property manager in considering whether you get an apartment,' says McClary.

Bottom line

Apartment owners may consider more than your credit scores when conducting a background and credit check. Stay on top of your credit reports so they accurately reflect your credit history, and find alternative proof that you've paid accounts on time, if necessary. It may also help to seek rental or credit counseling to demonstrate that you're serious about being a responsible tenant.

Working on your credit? Check My Equifax® and TransUnion® Scores Now